China Electric Car Market — 28% Share Of Auto Sales In June!

Plugin vehicles continue to be all the rage in the Chinese auto market. Plugins got back into the fast lane, growing 132% year over year (YoY). They scored over 565,000 registrations in June, a new record. Plugin hybrids (PHEVs) surged 179% year over year (YoY). They reached a record 124,000 registrations in June. Their growth even beat the growth of BEVs, which was a paltry 121%….

Share-wise, with June showing a record performance, plugin vehicles hit “only” 28% market share since the overall passenger car market surged 41%. That surge was thanks to the start of the tax cut on most fossil fuel models (cars with an engine size lower than 2000 cc and priced below 300,000 CNY, or $44,000, got their registration tax reduced to half). Full electrics (BEVs) alone accounted for 22% of the country’s auto sales! This pulled the 2022 share to 26% (20% BEV).

If electrification continues at this pace, this market will be BEV-based by 2025! Imagine that: the largest automotive market in the world being BEV-based in three years time!

Another measure of the importance of this market is the fact that China alone represented over half of global plugin registrations last month.

Tesla Model Y #1 Overall!

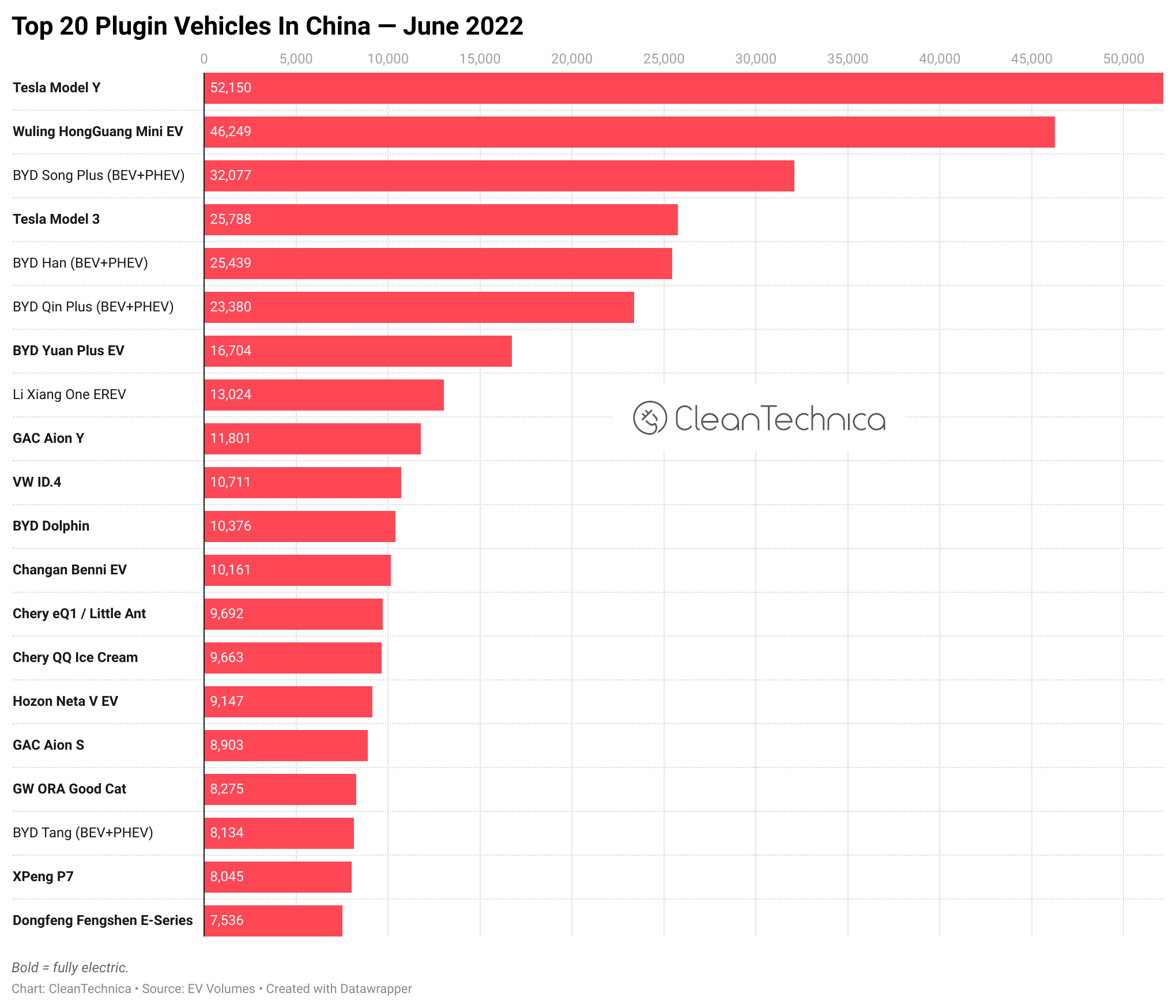

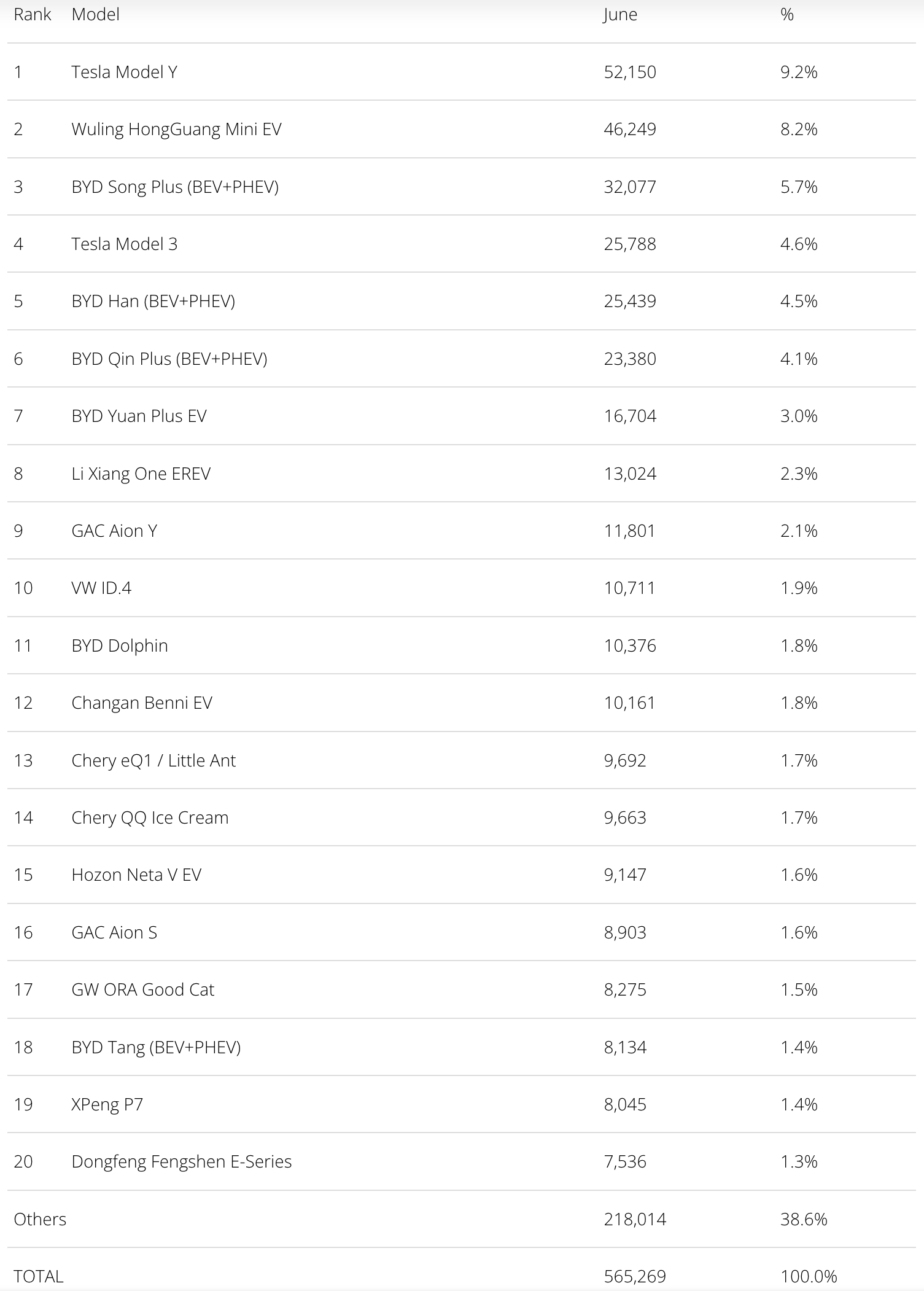

Looking at June best sellers, the highlight is the Tesla Model Y beating the rest of the competition, including the little Wuling Mini EV, and winning the Best Seller title — not only in the EV category, but overall!

In fact, the top positions of the overall market were populated by plugin models. Aside from the Tesla Model Y winning the leadership position, the Wuling Mini EV was 3rd, the BYD Song (BEV + PHEV) ended the month in 5th, the Tesla Model 3 was in 8th place, the BYD Han (BEV + PHEV) was 9th, and the BYD Qin Plus (BEV+PHEV) was 11th!

This meant that there were 6 plugin models in the overall top 11. And the 5 fossil fuel models (#2 Nissan Sylphy, #4 Toyota Corolla, #6 VW Lavida, #7 VW Bora, #10 Honda CR-V) were in the minority….

Here’s more info and context on last month’s top 5:

#1 — Tesla Model Y

With a record 52,150 registrations last month, the family-friendly Tesla won June’s overall best seller title. This was thanks to the post-covid lockdown production ramp-up, and the fact that there were few exports, allowing the maker to focus on domestic allocation, in order to fulfill the increased orders backlog. With increased production and a 4 month-average waiting list, expect Tesla’s crossover to continue running for the top spots in the future.

#2 — Wuling HongGuang Mini EV

With 46,249 registrations last month, the tiny four-seater had to settle with the runner-up spot this time. Still, with the little EV now cruising at around 35,000+ units per month, it has become a trendsetter and a disruptive force in urban mobility. It has racked up plenty of big trophies in the cutthroat Chinese market along the way. And while many deride it for “not really being a car,” the truth is that for a little over $4,000 USD, you have an EV that has 4 wheels, 4 seats, and a roof — which for many is enough to run their daily errands. Also, it’s apparently bigger than many assume. The added bonus is that the people buying it (mostly females, mostly under 35 years old) are usually a hard-to-capture audience. The model and its success mark a new chapter in EV mobility.

#3 — BYD Song Plus (BEV+PHEV)

BYD is looking to replicate the Model Y’s success with its own midsized SUV, with its ramp-up still underway. The PHEV version got a record 26,517 registrations in June, while the BEV hit a record 5,560 registrations. This earned it the bronze medal, with its 32,077 registrations far below the Wuling HongGuang Mini EV but well above the Tesla Model 3. At this point, the Song ramp-up is starting to slow down, so we might be close to finding the model’s cruising speed (probably around 30,000 units/month). This won’t be enough to remove the little Wuling Mini EV from its leadership position, but it could be enough to keep its Tesla Model Y archrival in the rearview mirror.

#4 — Tesla Model 3

With 25,788 registrations last month, Tesla’s midsize sedan earned itself a top 5 presence. It beat its BYD rivals, something that is starting to become rare in China. Thanks to the production ramp-up following the somewhat recent covid lockdown, and the fact that there were few exports (allowing the automaker to focus on domestic allocation), Tesla was able to fulfill the Model 3’s order backlog. With increased production and a 4 month-average waiting list, expect Tesla’s sedan to increase output and start competing with BYD’s sedans for the category leadership position.

#5 — BYD Han (BEV+PHEV)

BYD’s flagship sedan secured a best ever 25,439 deliveries in June, which is the result of a record 12,945 units of the BEV version and an amazing 12,494 units of the PHEV version. This is the result of the market launch of a slight facelift and revised specs. The upgrade includes a new 85 kWh battery for the BEV version and up to 38 kWh batteries for the PHEVs, making both versions truly class-leading when we look at their pricing ($33,000 USD for the PHEV version and $41,000 USD for the BEV — less than a base Tesla Model 3). This sales surge meant the full size BYD outsold its smaller sibling Qin Plus and almost caught the Tesla Model 3, an impressive feat for a car from the segment above. With the revised Han said to have tens of thousands of orders waiting to be produced, expect the big sedan to stay among the top selling models during the coming months, even if that means a higher ratio of PHEVs in its mix. In fact, with average sales now set at around 200,000 units/year, expect it to win the full size category — not only in China, but also globally.

Looking at the rest of the best seller table, in a record month it is only natural that record performances abound, and such is the case. Besides the aforementioned ones (the Tesla Model Y, BYD Song, BYD Han), below them we can see BYD flexing its muscles further.

In addition to placing 4 models in the top 7, the Shenzhen automaker also had the BYD Qin BEV score a record 11,269 registrations and the #7 BYD Yuan Plus reach 16,704 registrations in its fifth record performance in a row (proving that the compact crossover’s production ramp-up is far from over and that it could reach 20,000+ units/month soon). This also completes BYD’s lineup of sales champs in every category (Han in the full size category; Song as midsize king; Yuan leading the compact category; and Dolphin #1 in the subcompact category). And let’s not forget the upcoming BYD Seagull, the automaker’s future representative in the city EV category.

But enough about BYD — other models also deserve a mention, especially the ones with record scores. There’s the #9 GAC Aion Y, with 11,801 registrations, and the VW ID.4, which jumped to #10 with a record 10,711 registrations. Does this mean we will see the German crossover have a stronger second half of the year?

In the second half of the table, we see Hozon’s Neta V hit a new personal best score, 9,147 registrations. That allowed it to reach #15. Dongfeng’s Fengshen E-Series sedan also got a record result, 7,536 registrations, putting it in 20th place.

A sign of how fast the plugin market is growing is the fact that the AITO M5 EREV, despite jumping from 5,033 registrations in May to 7,021 registrations (its fifth record score in a row), dropped to #22 in June. It landed below another model in full ramp-up mode, the BYD Destroyer 05 PHEV. With 7,464 deliveries, the Destroyer 05 PHEV had its 3rd record score in a row. Both models should be followed closely, as both should become regular faces in the top 20 soon.

Still outside the top 20, a mention goes out to important developments on the legacy OEM side, the most important of which is Geely launching two new models. Both already have relevant sales volumes — the Geometry E, a small crossover, had 4,033 registrations, and the Emgrand L Hi-X PHEV, a sedan, had 4,035 registrations. Clearly, Geely’s trying to hit back at BYD’s model strategy. It’s also important to mention the record 4,417 registrations of the Volkswagen ID.6 — it seems VW’s big SUV is starting to get some traction. Lastly, Dongfeng’s Venucia D60 EV hit a record 4,522 units.

On the new blood side, Leap Motors continues to ramp up its C11 midsize SUV, to 4,848 units last month, the XPeng P5 midsizer was up to 5,598 units, and NIO’s new ET7 stylish flagship sedan is also ramping up, in this case to 4,040 units, its third record score in a row.

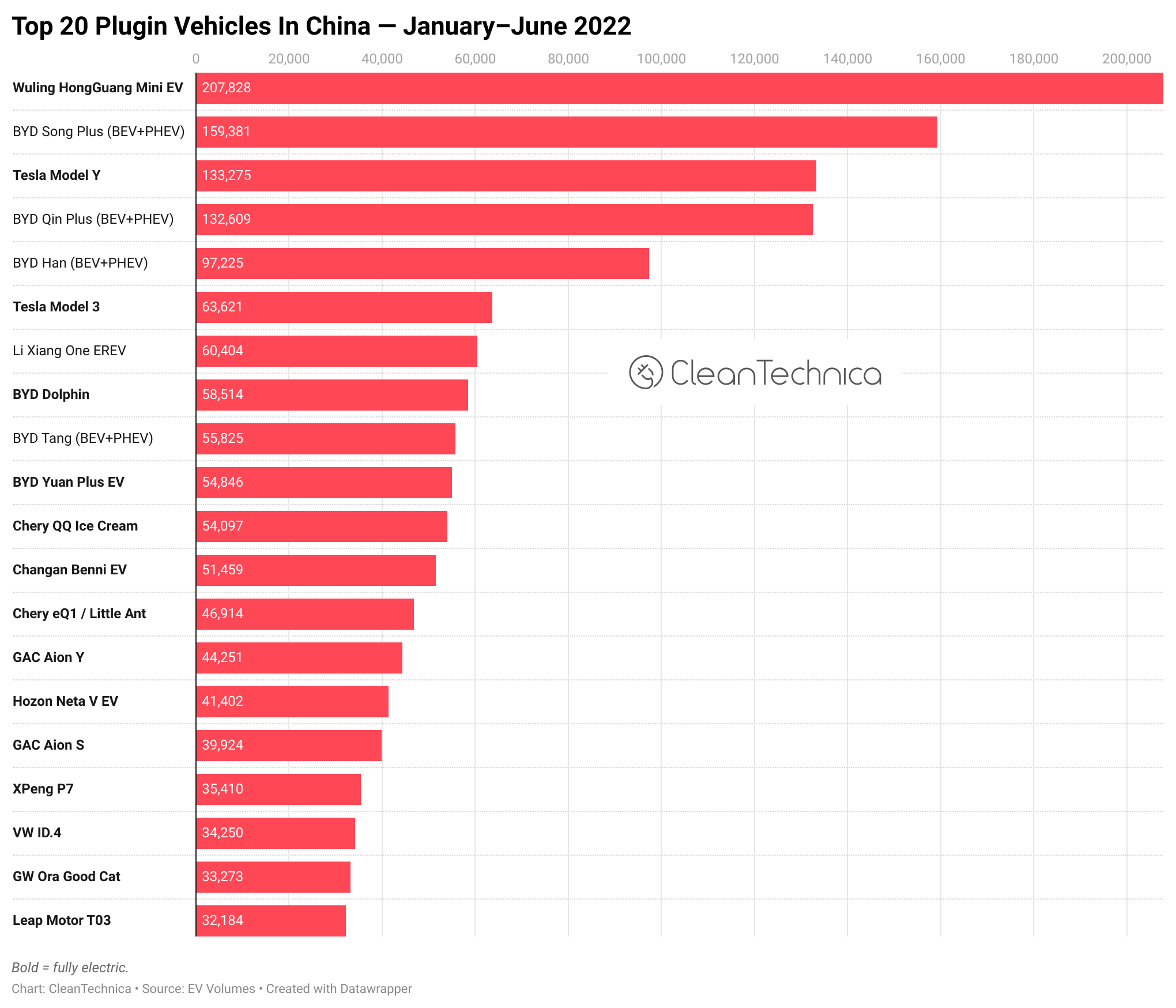

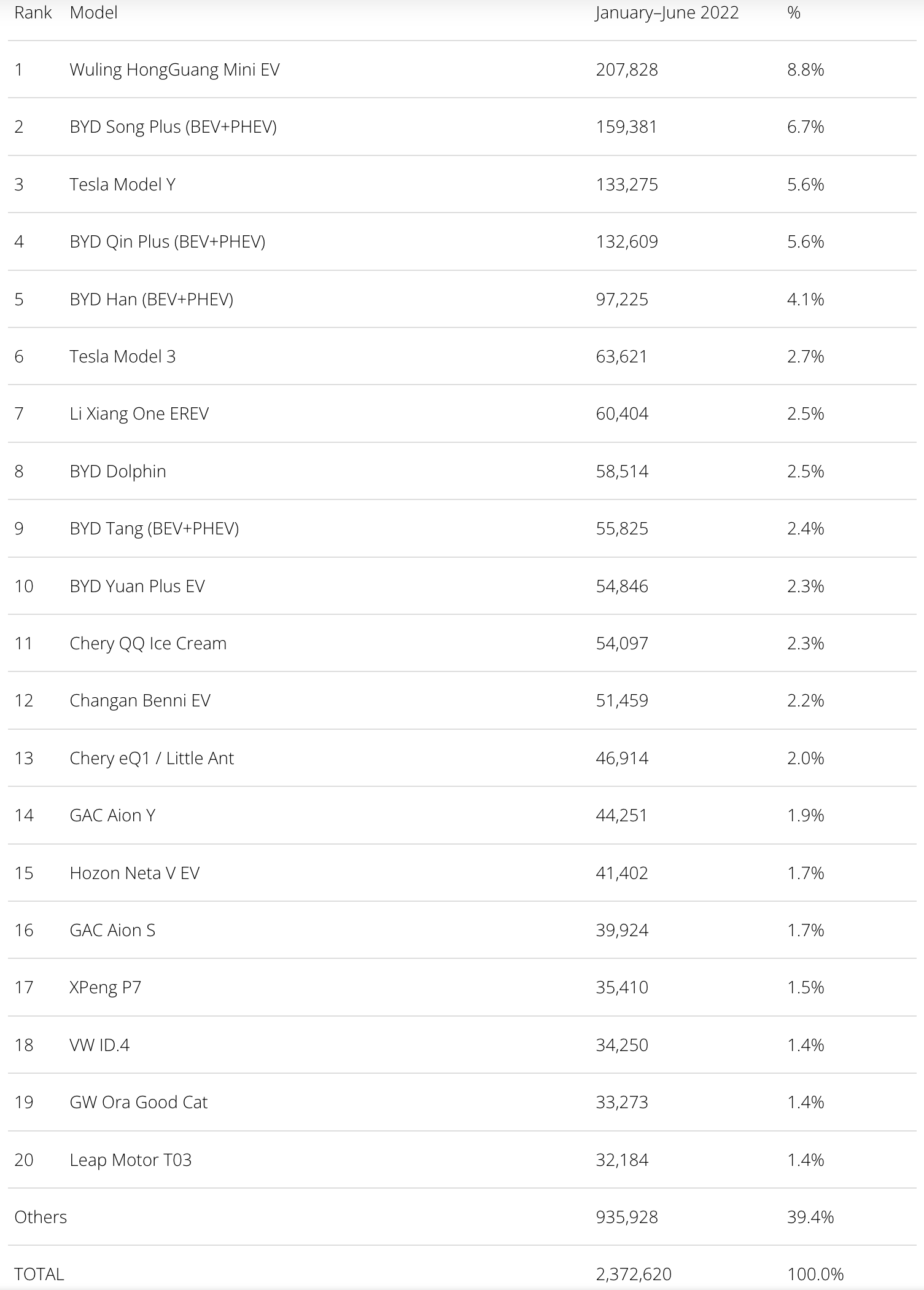

Wuling HongGuang Mini EV Still #1

Looking at the 2022 ranking, the Tesla Model Y climbed one position, to 3rd, surpassing the BYD Qin Plus, and should spend the rest of the year trying to reach the #2 BYD Song Plus in the race for best selling crossover/SUV.

Another Tesla on the rise was the Model 3, which jumped six positions, to … 6th. With its direct rival, the #4 BYD Qin Plus, having double the registrations, it should be difficult for the Tesla sedan to retain the midsizer best seller title — but there is a chance that the Model 3 can still surpass the #5 BYD Han in the second half of the year.

The BYD Yuan Plus climbed to #10. That puts six BYDs in the top 10!

As for the second half of the electric car sales table, we should highlight the #14 GAC Aion Y (go, team MPV!) gaining ground on the competition. The compact MPV will try to climb a couple more positions in the table.

The Volkswagen ID.4 had reasons to smile, climbing two spots to #18 on the electric car charts.

BYD Dominant

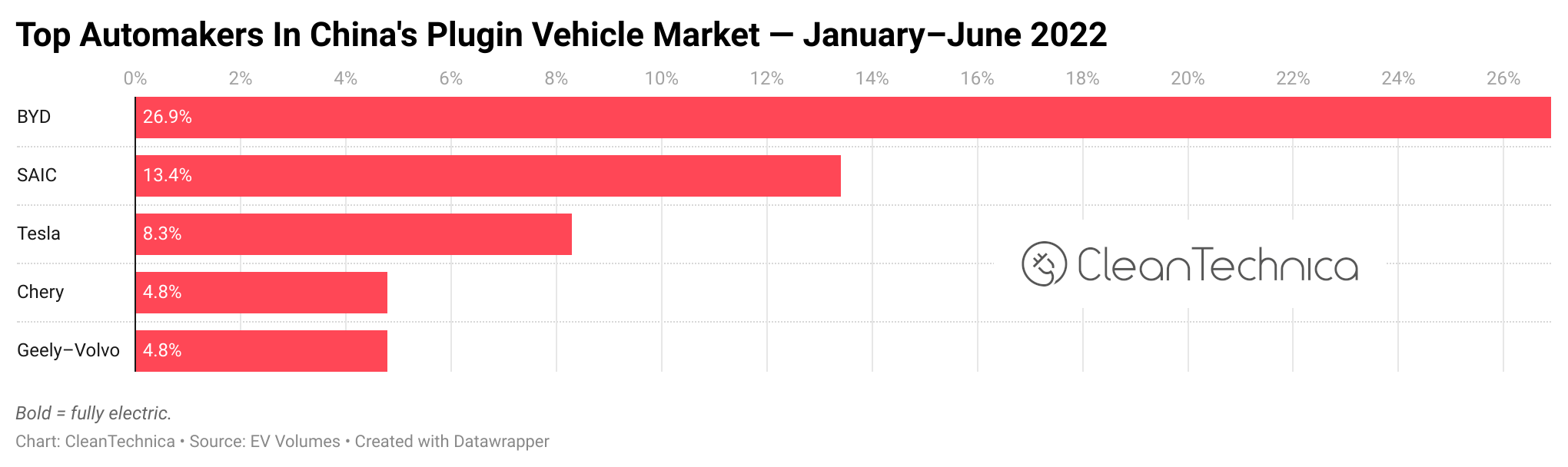

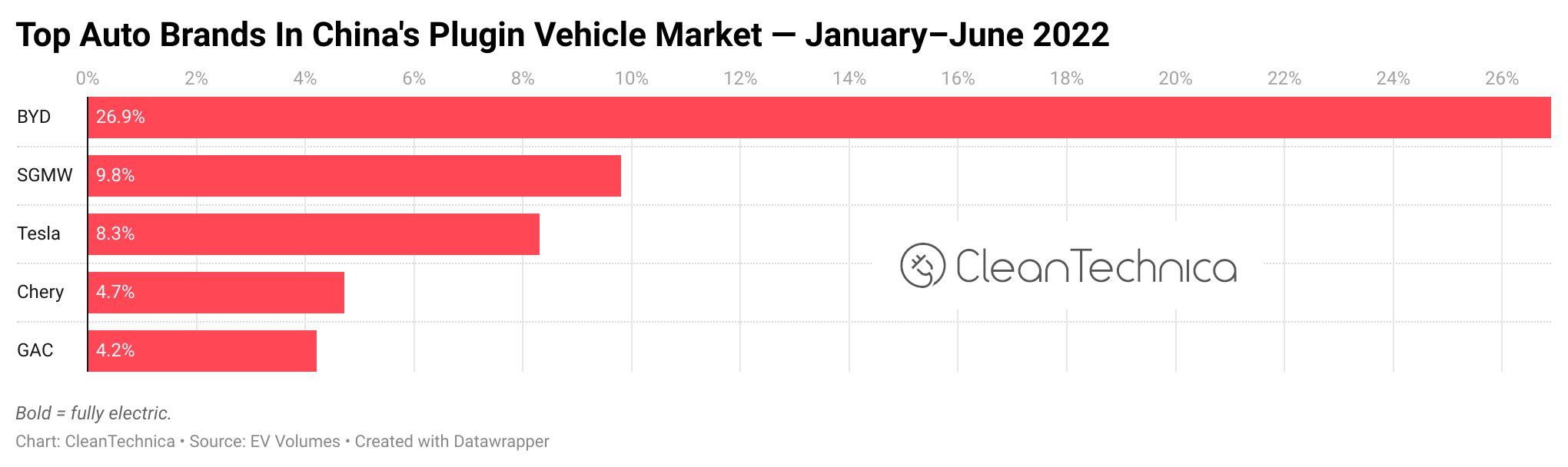

Looking at the auto brand ranking in electric car sales, BYD (26.9%, down 1% share) remains the dominant force in the plugin market, but seems to have found its ceiling share-wise. It was the 4th best selling brand in the overall auto market, thanks in part to another record monthly performance. Although, I feel this ranking is bound to change in the coming months as the market continues to transition further into electrification and BYD profits from the EV disruption.

Regarding the plugin market only, behind leader BYD we have runner-up SGMW (9.8%) in 2nd position, losing 0.3% share. It is suffering from the fact that it’s currently a one-trick pony (Wuling Mini EV) in an increasingly pulverised market where you need a lineup of models selling in high volume to remain successful.

At this moment, the Shenzhen automaker already has its 9th automaker title in the bag.

Thanks to a strong peak month, Tesla (8.3%, up 1.7% share from 6.6%) is stable in 3rd, Chery (4.7%, down slightly from 4.9%) stayed in 4th, and #5 GAC (4.2%) kept its distance over #6 SAIC (3.6%). But SAIC and even GAC and Chery should keep an eye on two sleeping giants that are seemingly waking up — both Volkswagen (3.4%) and Geely (3.0%) have seen their shares grow recently.

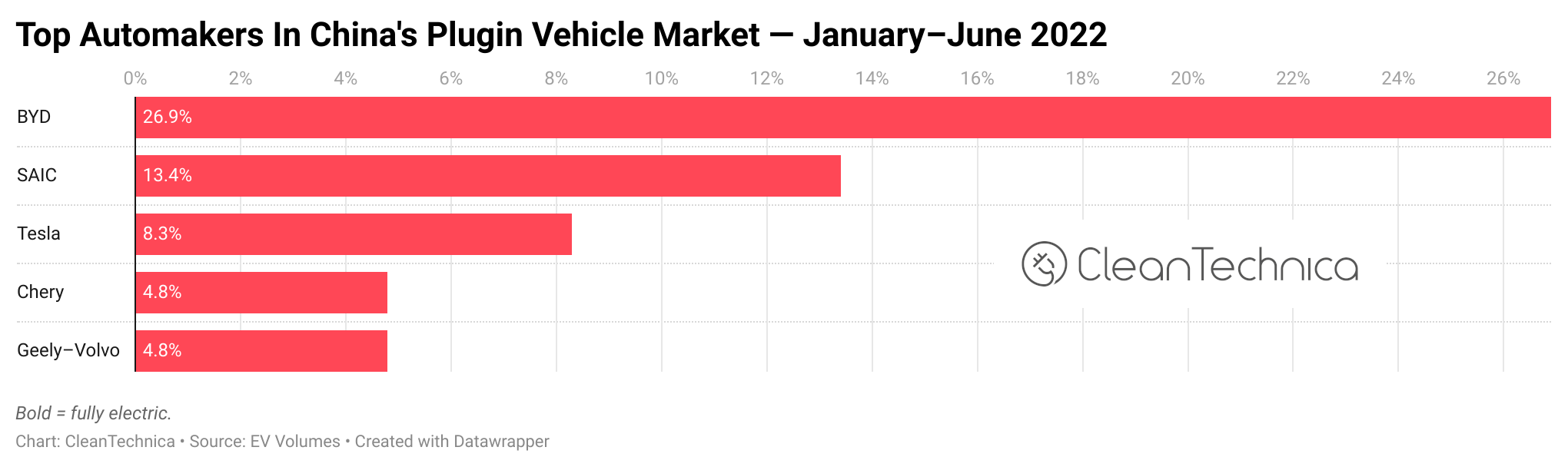

Looking at OEMs/automotive groups/alliances in the electric car space, BYD (26.9%) is comfortably leading, while SAIC (13.4%, down from 13.7%) remains steady in the runner-up spot for electric car sales. Tesla (8.3%) is also firm in the last place on the podium.

Outside of the electric car sales podium, things are more interesting, with Geely–Volvo (4.8%, up 0.2% share) surpassing Chery (4.8%, down from 5%) and #7 Volkswagen Group (3.9%, up from 3.6%) surpassing Dongfeng and looking to reach #6 GAC (4.4%).

Still, with less than half of the sales of Tesla, it is nearly impossible for the German conglomerate to get close to the US automaker. Although, the same cannot be said about Geely–Volvo, as its growth potential is not only greater (just look at the recently arrived Geely Geometry E and Geely Emgrand L Hi-X PHEV), but it has also shown the will to take chances and win customers. (Why, oh why, hasn’t Volkswagen launched the Skoda Enyaq in China yet? It just baffles me. … It’s like keeping Lionel Messi/LeBron James on the bench while losing the game by a large margin at half time. … It’s like they are not even trying!)

Appreciate CleanTechnica’s originality and cleantech news coverage? Consider becoming a CleanTechnica Member, Supporter, Technician, or Ambassador — or a patron on Patreon.

Advertisement