Newsom’s budget cuts threaten to delay California’s new environmental disclosure laws Leave a comment

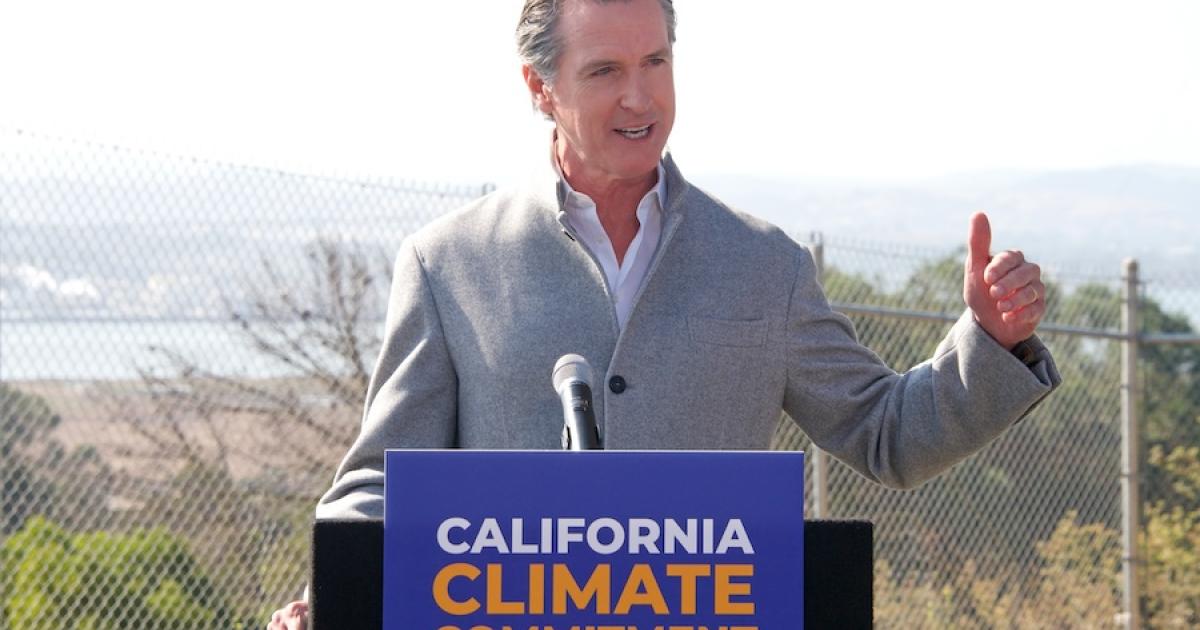

California Gov. Gavin Newsom announced a surprise funding cut this week to the California Air and Resources Board (CARB) in his proposed budget for 2024-2025. The cut was due to Newsom’s desire to close California’s $37.9 billion budget deficit.

If passed, their effect will be to delay the implementation of the new Climate Corporate Data Accountability Act (SB 253) and the Climate-Related Financial Risk Act (261), which CARB oversees.

Passed in October, SB 253 requires both private and public companies in California with revenues greater than $1 billion to disclose comprehensive reports of their Scope 1 and 2 emissions, starting in 2026.

SB 261 — also passed in October — requires companies operating in California, with revenues greater than $500 million, to bi-annually report climate-related financial risks and mitigation strategies.

Before passage, both laws had the support of corporations such as Apple, Google and Salesforce, although they were opposed by the state’s Chamber of Commerce, which argued the new rules were burdensome and expensive.

Newsom’s new goal to close the deficit resulted in a pause on all newly signed laws, including SB 253 and 261. Gov. Newsom’s office did not respond to a request to comment.

The $9 million required by CARB to implement the climate laws is approximately three ten-thousandths of one percent of California’s annual budget, according to a statement from State Sen. Scott Wiener (D), author of SB 253.

“It’s critical that the May budget include funding to implement these laws so that businesses have the certainty they need to prepare to make these new disclosures,” said Wiener in the statement.

“Companies and investors cannot afford any delay in the implementation of California’s climate disclosure laws,” said Steven Rothstein, managing director of the accelerator for sustainable capital markets at Ceres, in the same release. “Not only do investors, consumers and other stakeholders deserve better … but businesses deserve the standardized, consistent and economy wide disclosure rules that this legislation promises.”

Emily Pierce, chief global policy office at carbon accounting and consulting firm Persefoni, told GreenBiz that despite the apparent bump in the road, businesses should continue to prepare for a 2026 disclosure timeline.

“If a business is only focused on California and [SB 253] was its only reason that it was going to calculate carbon emissions, I would suggest that it look around and take a more comprehensive assessment of what’s happening in the global marketplace.” Pierce is referring to the European Union’s Corporate Sustainability Reporting Directive and Australia’s upcoming implementation of its own corporate disclosure laws.

GreenBiz will continue to closely follow this developing story.