The Clear Way to Buy Clearway

By Tom Konrad, Ph.D., CFA

A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A shares (CWEN-A) or Class C Shares (CWEN).

For tax purposes, they are identical. They pay the same dividend, and it is treated the same no matter which share class you buy. The reason many large investors often trade CWEN rather than CWEN-A is because it is more liquid. As I write on Jan 23rd, Yahoo! Finance puts the 3 month average share volume for CWEN at 1,372,714, while the corresponding number for CWEN-A is 412,958. When you are trading tens of thousands of shares, this can make a big difference. For you (presumably) and me, not so much. I actually like illiquidity, since I usually trade using limit orders, and let people who want to trade a lot of shares come to me, rather than chasing the current market price.

Because large investors prefer CWEN, it usually trades at a small premium to CWEN-A, even though the dividends are the same, and a single share of CWEN-A represents 100 times more votes when it comes to proxy ballots. This is only a big deal when there are rumors of a possible buyout or similar corporate action, but at such times the price premium CWEN usually enjoys is likely to become a discount, as investors who care how the vote turns out focus on buying votes instead of liquidity.

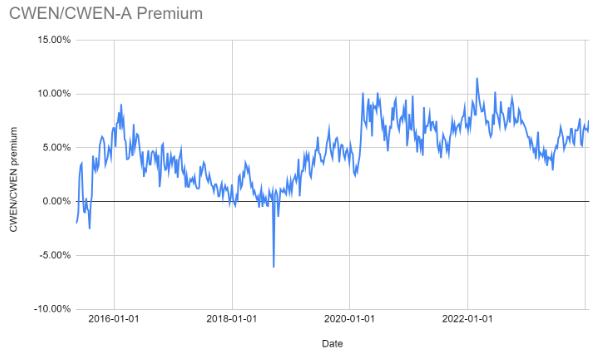

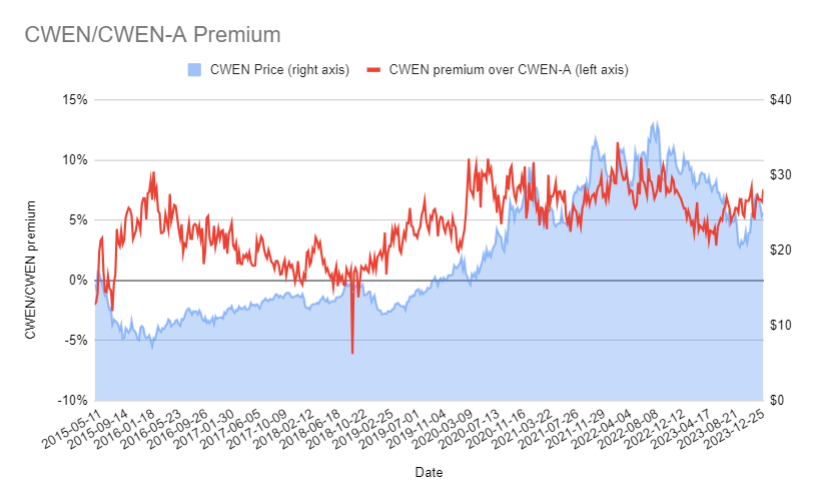

As you can see from the above chart, CWEN usually trades at around a 5% premium to CWEN-A, meaning you have to pay about 5% more for a class C (CWEN) share, even though you get more votes and the dividend is the same (so the percent dividend yield a.k.a. dividend for every $100 invested higher.)

Recently, the CWEN premium has been rising, and is around 7.5%. I’ve always bought CWEN-A. Now, if anything, CWEN-A is an even clearer way to buy Clearway.

Maybe I Was Wrong?

I started this article by saying that there was no difference between CWEN and CWEN-A for tax purposes. But now I’m thinking that the CWEN premium is more likely to narrow than widen in the medium term, so there is one difference: You’re likely to make more money buying CWEN-A than CWEN, and making money leads to a higher tax bill.

So if taxes are all you care about, you should buy CWEN. Those of us who care more about making money should buy CWEN-A.

DISCLOSURE: As of 1/23/2024, Tom Konrad and funds he manages own the following securities mentioned in this article: CWEN-A. In the next two weeks, he may buy more or CWEN-A, and might sell some CWEN short as an arbitrage trade, especially if the premium over CWEN-A increases.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

ABOUT THE AUTHOR: Tom Konrad, Ph.D., CFA is the Editor of AltEnergyStocks.com (where this article first appeared) and a portfolio manager at Investment Research Partners.